Property TAX Management System

Government of Uttar Pradesh

NeoGeoInfo has done this project for the Ministry of Communications & Information Technology.

Type of service

Preparation of Property Tax Register based on GIS and Revenue Survey with Technical Handholding Support.

Scope of Work

Survey and Data Creation

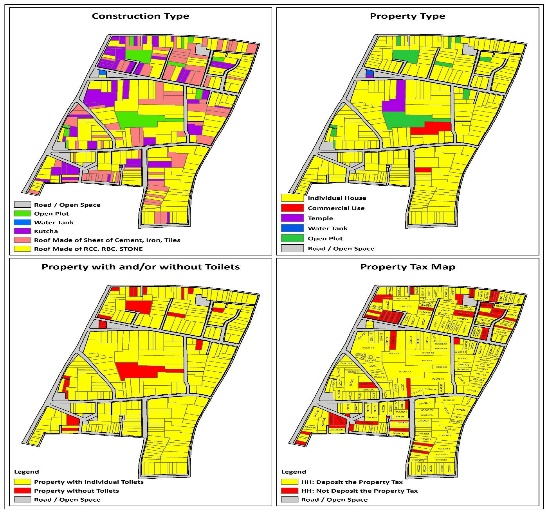

- Creation of a GIS-based spatial property database using high resolution satellite imagery geo-referenced control points taken by dual-band GPS (DGPS) survey, and updated by ground trothing (validation). The property boundary layer is then migrated on top of this GIS base map to create homogenous GIS data layers.

- Data Digitization and Geo-database Creation

- Collection of 200 DGPS points

- Geo referencing of the GIS data using DGPS points collected above

- Contact survey of properties in association with Municipal Staff for:

- Creation of Land base, Plot area, carpet area based on construction with usage type.

- Assign unique parcel / premises number,of the properties situated-in the Municipal Ward boundary.

- Along with other physical inputs required for the planning of the City like Road network, Parks, railway tracks, rivers, electric poles, telephone poles, transformers, substations, drainage systems, sewer lines manholes, hand pumps hospitals, nursing homes, post office, police station, SWM dumping sites and locations, temples, mosques, pumping stations, tube wells, culverts, bridges, graveyard ,utilities, Overhead Tanks, canals, open drains, water bodies, bridge, culverts etc,.

Preparation and migration of existing Municipal data with GIS data to UADD and https://www.mpenagarpalika.gov.in/ website

- Development of desktop application for property database repository management and tax assessment with the ability of tax rates updation.

- Development of informative and interactive web-GIS system for online property tax calculation and payment

- Furnish a completion report along with 2 copies of final maps on 1:1000 scale ward wise with assessment database and 1 :10,000 scale maps’.

- Up gradation and matching of Existing Municipal Revenue data with Special Location in GIS -Application Development / Up gradation for existing desktop GIS application.

- The development activity report submission every two weeks for review by client.

- Implementation conforming to the typical stages of software Development Life cycle including the following –

- Requirement Analysis

- System Design

- Application Coding

- Testing

- Acceptance

- Deployment

- Support in distribution of Single page in each Householde

- Managment of Dava – Appti by House owner.

- Provide training to ULB Staff about GIS and Revenue Software.

- Providing Technical Support for Three years in ULB.

Previous Situation

In Madhya Pradesh Bundelkhand Region, Mostly all Urban Local Bodies depend on Government and the revenue collection from property tax to finance their infrastructure and city operations. Lack of these funds causes growth and progress to be delayed and reduces the economic potential of the city. By developing a GIS-based tax assessment and management system the city government is able to: check the total tax collected for a defined area like a ward; compare this against what would be expected to be collected from the ward; re-plan tax amount based on changing urban development plan and new construction; and develop more detailed system focusing on new development areas to improve tax collection.

It was a very unpleasant situation in the city, as there was differential rate of implementation of property tax norm for both the industrial, non-industrial, commercial and residential buildings despite the fact that they were located in the same location. This used to be the bone of contention between citizens and Nagar Parishad. Though, citizens used to pay taxes but they were not very regular in payment and thus it finally resulted in to litigation case to the citizens as well as for ULB. After mapping, categorization and defining usages of construction, there is remarkable growth in tax collection.

Implementation Strategies

The major problems in ULB were, there was no proper map of the city or the areas of tax collection, nobody really knows how many taxable property units there are in ULB because of everyday construction work, the tax collectors (Revenue Inspectors) had minimum training to use any computer assisted methods and the present assessment method was extremely tedious and resulted in a growing number of un-assessed property, hence no tax could be issued etc.

So, to eliminate all these issues, ULB along with the Directorate of Urban Administration & Development made strategies for better implementation of the reform. It was decided that a change to the revised practice needs to be implemented. In order to get the revenue collection on a systematic track, it was necessary to agree on the following:

- A new base map is needed to make it possible to identify all taxpaying units (houses).

- A method of identification of the taxpaying units needs to be developed.

- A supporting Geographical Information System (GIS) needs to be developed.

- The revenue collection needs to be reorganized to utilize the GIS application.

- The staff needs to be trained to utilize the new system.

Achievements/ Results

This reform became a huge success in ULB to create an umbrella effect for covering large number of properties under it. The data shows that:

Increase in number of property after GIS Survey in Khajuraho ulb in Single Ward

Ward | No. of Assesses before GIS survey | No. of Property assessed after GIS Survey | No. of Assesses added after GIS survey |

1 | 439 | 384 | 783 |

This shows that, the number of properties increased double. Properties were added into the tax net. Hence, the new reform is beneficial for both Government and the ULB.

Additional Revenue Generation

Due to the new technique, categorizations of Property use and use of proper survey method with efficient and skilled professionals, the property tax revenue generation increased manifold

GIS ULB

Use of GIS has opened a whole new horizon to the ULB for database preparation and assessment of property through this very proficient technique.